Frequently Asked Questions About Shri Aarambh Commercial Vehicle Loans

What is Shri Aarambh Commercial Vehicle Loan?

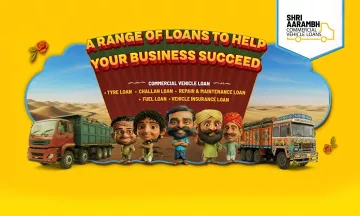

Shri Aarambh is a comprehensive Commercial Vehicle Loan solution by Shriram Finance designed specifically for transporters, truck owners, and fleet operators. It is not just a truck loan — it is a complete financial support system that helps transport businesses manage vehicle purchase, operations, and running expenses with ease.

What products are included under Shri Aarambh Loans?

Shri Aarambh primarily offers Commercial Vehicle Loans (CV Loans) and is bundled with additional financing solutions required for the transport business, including:

- Tyre Loans

- Repair & Maintenance Loans

- Fuel Loans

- Challan Loans

- Vehicle Insurance Funding

This bundled approach ensures transporters get both vehicle finance and working capital support under one platform.

Why Choose Shri Aarambh Commercial Vehicle Loans?

Shri Aarambh provides timely financial support for your transport business’s operational needs — ensuring your vehicles keep running without cash flow disruptions.

- Quick approvals & fast disbursals

- Minimal documentation & easy process

- Competitive & customised interest rates

- Funding tailored to your operational requirements

- EMI alerts & reminders for timely payments

How quickly will my loan be approved and disbursed?

Shriram Finance offers quick approvals and fast disbursals with minimal documentation, subject to eligibility and verification.

How are the interest rates determined?

Interest rates are competitive and customised based on your financial profile, eligibility, and loan type.

Will I receive reminders for EMI payments?

Yes, timely EMI alerts and reminders will be sent to your registered mobile number and email to help you stay on track.

How do I use the EMI Calculator?

Select the loan amount, tenure (in months), and interest rate using the sliders. The EMI will be calculated automatically as you adjust the inputs.

Is the EMI calculated instantly?

Yes. The EMI updates in real-time whenever you move the sliders.

Can I change the values and recalculate?

Yes. You can modify the loan amount, tenure, or interest rate anytime to instantly recalculate your EMI.

How can I apply for Shri Aarambh Commercial Vehicle Loans?

You can apply online by registering with your mobile number, verifying via OTP, entering your personal details, and then waiting for our representative to contact you.

Is mobile number verification mandatory?

Yes. OTP verification is required to proceed with the application and ensure secure processing.

What happens after I submit my details?

Once you complete the registration and enter your details, our representative will contact you to guide you through the next steps of the loan process.

Who is eligible to apply for Shri Aarambh Commercial Vehicle Loans?

Individuals engaged in a transport-related business and aged between 18 and 70 years* are eligible.

(*The applicant should not be older than 70 years at the end of the loan tenure.)

What documents are required to apply?

You need to provide:

- Identity & Address Proof (Aadhaar, Passport, Driving License, etc.)

- Income Proof (Bank statements, ITR, audited financials, etc.)

- Relevant asset-related documents, if applicable.

Is income proof mandatory for loan approval?

Yes. Income proof such as the last three months’ bank statement, ITR, or audited financial statements is required to assess eligibility and repayment capacity.

What is the interest rate for Shri Aarambh Commercial Vehicle Loans?

Interest rates vary based on your financial profile, loan type, and eligibility. For detailed information, please refer to our Interest Rate Policy.

Where can I check the latest interest rates and charges?

You can review the updated interest rates and applicable fees in our Interest Rate Policy available on the website.

Easy & Quick Disbursals on Shri Aarambh Commercial Vehicle Loans